.jpg) With erratic prices, corporate scandals and "market corrections," you may think you already have enough to worry about when it comes to trading stocks. But there is one more important worry to add to the pile -- investment fraud.

With erratic prices, corporate scandals and "market corrections," you may think you already have enough to worry about when it comes to trading stocks. But there is one more important worry to add to the pile -- investment fraud.

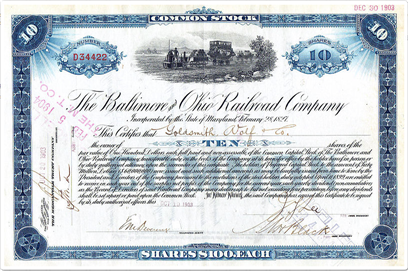

Long before the days of online trading, a few unscrupulous brokers defrauded investors or absconded with their money. Fraudulent firms known as boiler rooms have also employed brokers to make unsolicited phone calls to investors, selling bogus or overvalued stock. People must evaluate their broker's ethics and judgment, and part of the broker's job is to protect investors from fraudulent stocks.

With online trading, though, people must research stocks on their own, deciding what to buy and sell without the help of a broker or an investment planner. Fraudsters have taken advantage of this, leading to several notable methods of defrauding investors. These include:

- Pump-and-dump schemes - People spread the word about a "sure thing" stock via online message boards, online stock newsletters, email and other methods. The resulting interest in the stock drives up the price. The organizers of the scheme sell their stocks for a huge profit, and then stop promoting it. The price plummets, and investors lose money.

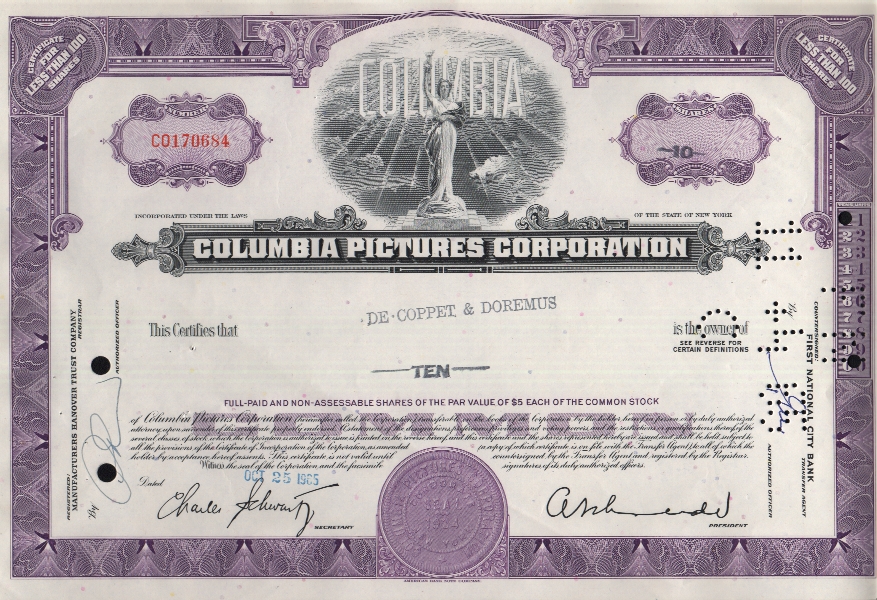

- Fraudulent IPOs - Some investors like IPOs because they provide a chance to "get in on the ground floor" and to make a substantial profit. Some scammers, though, spread the word about an upcoming IPO for companies that never intend to go public or that don't exist. Then, they abscond with investor' money.

- Fraudulent OTC stocks - Con artists promote stock in companies that do not exist or start a pump-and-dump scheme for an OTC stock. After investors buy stock in non-existent companies, scammers simply take the money and run.

- Fraudulent company information - Publicly traded companies have to release information about financial performance. Overstating or misrepresenting a company's goals and achievements can drive up the stock price.

Fortunately, you can protect yourself from most of this by doing your own research. In addition to researching your brokerage, you should research any company you plan to invest in, including reading annual reports and financial statements. You should also check the SEC's Electronic Data Gathering, Analysis & Retrieval (EDGAR) system, especially if you are going to participate in an IPO. EDGAR includes IPO information and periodic reports from companies in the United States and other countries. Filing information with EDGAR is required by law.

Also, it's always a good idea to remember that if a stock deal seems too good to be true, it probably is.

Check out the links on the next page for lots more information on electronic trading, stocks and the stock market.

.jpg)