We reconsider, hang on TC new elements - again went ... but the result is the same. And so it goes on forever.Maybe the reason is not so in you and your trading system, namely, that where and what trade? After all, forex, we are bound only to a few appropriate tools (pairs trading), but within a year they change their behavior and we simply do not have time to track it (your old vehicle probably forgotten works now).

And if you did not ask the question why the percentage of successful traders on the Stock Exchange is much higher than in the Forex?So, allow you to select stocks for your trading tool that works on your vehicle right now, and if you then give a miss - you can easily replace it with another, because the choice of a large (only a few thousand of Nice, and the selection process at the beginning takes about 1 hour a day - and it has 70% chance for successful transactions). And this does not necessarily have supernavorochennogo vehicle in which you try to see what is not.

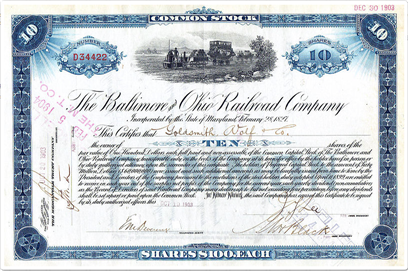

Maybe it meant A.Elder when gvoril that "gambling JUST"?Advantages and disadvantages of trading in shares:Advantages:- A wide range of actions: a trader can always find stocks that meet its requirements;- Access to specialist book, tape and volume of transactions, where you can see pending orders of market participants and the volume of transactions;- Actions more predictable and spend economic news, particularly in the section of economic sectors;- Availability of market-neutral stocks that go regardless of the market;- Transparency of trades - you can see the order sending the buyout market themselves and in turn are sent to the other;- The price per share for a world without changes;- The broker is still much you earn - it is not interested in losing a client, on the contrary it beneficial to your success because of the commissions;- Less risk, which affects the technicality, predictability, and smoothness of the shares. After all, the currency pairs reflect country risks at least two countries, and often more than is the case with the European Union, such as CHFUSD - reflected the risks in Switzerland, the United States and the European Union;- And finally, the subjective advantage to claim the leading traders of the number of successful traders share is much higher than in the forex.Disadvantages: large selection of stock, making it difficult for the selection and retention. But this lack is precisely the main advantage, and solved all of this is actually quite simple ...

Комментариев нет:

Отправить комментарий